It’s time to stop thinking public borrowing is a bad thing

Despite the change of government, one thing has not altered when it comes to governmenteconomic policy. Before the election, Jeremy Hunt was determined to rein in public borrowing and to stick to his self-imposed fiscal rules. Now Rachel Reeves, his successor, is just the same.

Before the election, no commitments could be made by Reeves and her colleagues unless they were “fully funded”, that is there would be no addition to public borrowing. This paranoia about additional borrowing has continued as Labour has moved from opposition into government.

On July 29, our new chancellor made a statement that allegedly uncovered a £22 billion “black hole” in the public finances. Despite subsequent analysis suggesting that half of this addition to the deficit was down to the chancellor’s own decisions, closing this “black hole” and reining in borrowing is likely to feature significantly in Reeves’ first budget on October 30.

Underpinning all this concern and anxiety is the notion that public borrowing is a “bad thing” to beavoided at all costs. This idea has been a damaging notion permeating British politics for manyyears. It is time to knock it on the head.

In the private sector, borrowing generally is regarded as part-and-parcel of a healthy economy.Businesses need to borrow to fund investment and to finance new initiatives. Households need toborrow for a mortgage to buy a house or to fund other large purchases. We rarely questionwhether this is a good thing or not.

Indeed, the most recent episode when excessive borrowing caused serious economic problemswas the 2007-09 global financial crisis, driven by excessive bank lending to the private sector. Inother words, private borrowing, rather than public borrowing, has been a bigger source ofeconomic instability in recent times.

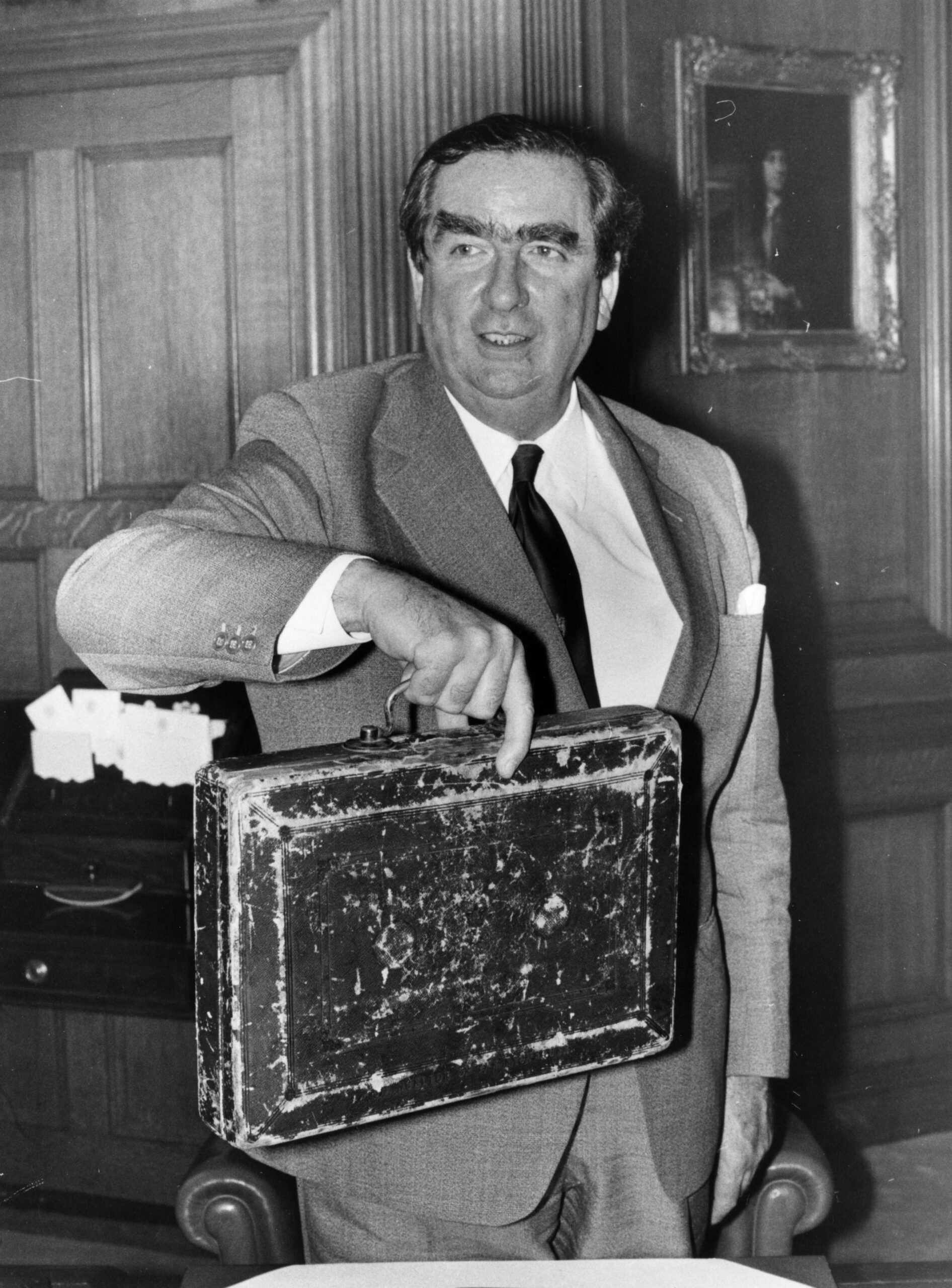

So why are we so preoccupied with high public borrowing? The answer lies in the mists of time,nearly 50 years ago. In the 1970s, the government borrowed too much and this led to aneconomic crisis in the mid-1970s, with Britain forced to go to the International MonetaryFund for financial support in 1976.

The scars of that experience run deep in our national psyche. We received a reminder ofthis episode when Liz Truss’s government came to power and appeared to be taking an irresponsible financial course. The economic and financial problems created by Truss and Kwasi Kwarteng, her chancellor, in 2022 were short-lived, but they were a reminder of the difficulties that can be caused by bad decisions on public finances.

In some countries, there have been recent crises in which the lack of public sector financial disciplinehas played a part in creating broader economic and financial problems. Greece and the eurofinancial crisis in the 2010s come to mind, as well as Argentina and the troubles of other South American states. But these are countries that have little in common with Britain.

In a country like the UK, which has run broadly sound economic policies for more than 300 years, thekey issue is to maintain the confidence of financial markets. This means ensuring that theinternational and domestic financial markets will buy government bonds because they haveconfidence in the economic policies of the government in power. If that financial confidence ismaintained, the exact level of public borrowing or debt is not a significant issue.

Clearly, it helps if the government in power follows some basic rules. In normal times, the level ofpublic borrowing should be kept at about 2 per cent to 3 per cent of GDP, what I would describe as the “safety zone” for public finances. That has been the case on average since 1948-49, when UK publicborrowing has averaged 2.8 per cent of GDP. In today’s values, this would mean a budget deficit of£60 billion to £90 billion.

It also helps if public borrowing is used to finance investment rather than current spending overthe longer term, which is a principle the new chancellor supported in opposition. But these areguidelines, not “fiscal rules”. If these guidelines are turned into iron-clad fiscal rules, they canbecome a straitjacket that prevents sensible economic policy decisions.

There will be times when public borrowing should be allowed to breach these limits. Recentexamples when this has happened are during the global financial crisis of 2007-09 and in itsaftermath, while the pandemic in the early 2020s placed strains on public finances that could not be accommodated by normal “fiscal rules”. In these circumstances, higher-than-normal borrowing is needed to keep the economy stable. The broader stability of the economy is more important than slavish adherence to a fiscal rule.

I am not advocating an uncontrolled splurge of public borrowing, Instead, we need a more flexibleapproach that allows the government to borrow when it is sensible to do so. If governmentborrowing is inhibited by so-called fiscal rules, we can be denying the opportunity to invest intransport and other essential infrastructure necessary to support the future growth of theeconomy.

Nor am I arguing for an unsustainable build-up of public debt. The economy has coped withvarying levels of debt. Over the postwar period, our public debt-to-GDP ratio has fluctuated between30 per cent of GDP and 250 per cent and at present is at 90 per cent to 100 per cent, close to the long-term average for the past 300 years. There is no economic theory that can dictate the ideal level ofpublic debt, but if public borrowing is properly controlled, then the level of public debt normally will take care of itself.

I doubt if these words of advice — to be more flexible about public borrowing limits — will appeal toReeves. She is likely to see more flexible fiscal rules as diluting the control of the Treasury over her spending colleagues. It is so much easier for the Treasury to insist that proposal X or policy Y will breach Treasury fiscal rules, rather than having a reasoned argument in cabinet on its merits.

So we are probably stuck with rigid and restrictive fiscal deficit and debt rules under thisgovernment. Sound economic arguments for more pragmatism and flexibility about the level ofpublic borrowing are, sadly, likely to go unheeded.

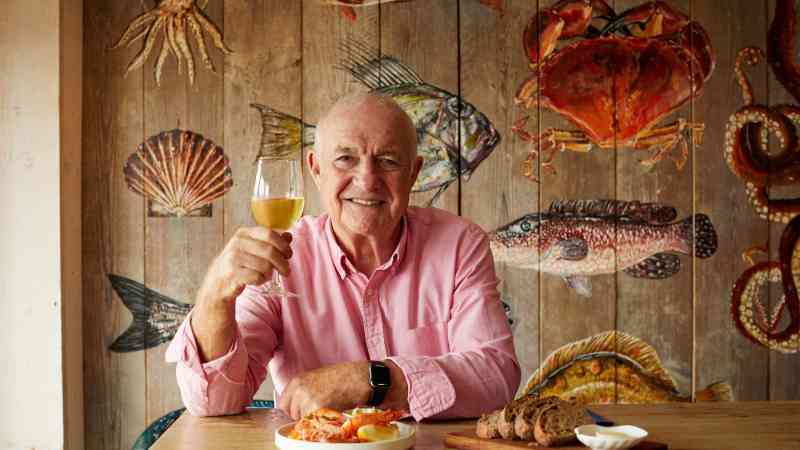

Andrew Sentance is an independent business economist and a former member of the Bank of England’s monetary policy committee

Post Comment