John Wood Group has ‘great future’ insists boss despite $1bn charge

The decision by Sidara to scrap a £1.6 billion takeover for John Wood Group this month was the second time in a little over a year that the engineering specialist had been spurned by a potential suitor. Nevertheless, Ken Gilmartin, the group’s chief executive, is confident that he can steer the FTSE 250 oil and gas services specialist towards a recovery without any outside interference.

“We can continue to be successful in the public markets,” he said. “We’ve got a great future as a company. We’ve got great people, we’ve got great client relationships and we’ve got great growth.”

That was despite the Scottish company booking almost $1 billion of exceptional charges in the first half of this year, which sent it deeper into the red as it recorded a pre-tax loss of $962 million.

It was hit by $815 million in impairments associated with historic acquisitions, alongside a further $140 million writedown relating to its decision to exit higher-risk, large-scale and turnkey projects in favour of reimbursable contracts that are less likely to turn lossmaking if conditions change.

Gilmartin said the writedowns had been a “prudent” measure and had come after he asked Arvind Balan, who arrived as Wood’s chief financial officer in April, to go through the balance sheet “line by line” to ensure that things were on track. There was no cash impact on the financial projections for 2024 or 2025 as a result of the impairments, he said.

“Investors understand that this is going to be a turnaround story and that it’s going to take a period of time for us to get to where we get to,” Gilmartin, 53, said. “For us and investors, it’s very simple. Continue to grow the way that we’re growing, continue to de-risk the company and get a clear line of sight to that significant free cashflow next year.”

• After two failed buyouts, what’s going on under the hood at Wood?

Sidara had three proposals rejected before Wood’s board decided to open its books at 230p a share. The Dubai-registered engineering consultancy walked away this month amid turmoil in global markets as weak jobs economic data from the United States sparked fears of an imminent recession. That came 15 months after Apollo Global Management, the private equity group, had decided not to move forward with its own 240p-a-share bid for Wood after completing due diligence on the company.

Wood noted $5.5 million of costs related to the approach by Sidara. It expects to take a further $5 million hit in the second half of the year in relation to the transaction.

Gilmartin said Wood’s staff had remained focused during the period of uncertainty. “We wouldn’t have achieved the results that we have in the first half if the team had become distracted by Sidara,” he said.

Its shares have fallen by 66 per cent over the past five years and are down by 20 per cent since the start of this year. Gilmartin indicated that his confidence in Wood’s prospects as an independent business had not wavered and pointed to research showing improved morale among its workforce.

The company is halfway through a three-year turnaround plan to strengthen its balance sheet and to improve profitability with better pricing and reduced operating costs.

Revenue was down 5 per cent to $6.2 billion, largely as a result of the projects division of the business shifting away from certain types of engineering, procurement and construction work.

The cash outflow in the period was $168 million, compared with $219 million in the first half of 2023. However, cash generation would continue to improve this year and the company would generate “significant cashflow” next year, it said. It has cut about $25 million of a targeted $60 million in cost savings.

Net debt remains above the company’s medium-term aim at $876 million, excluding leases, or 2.5 times adjusted earnings, compared with a range of between 0.5 and 1.5 being targeted.

Delivering better cashflow would allow for options around shareholder returns, Gilmartin said. Wood’s dividend has been suspended since the early months of the pandemic.

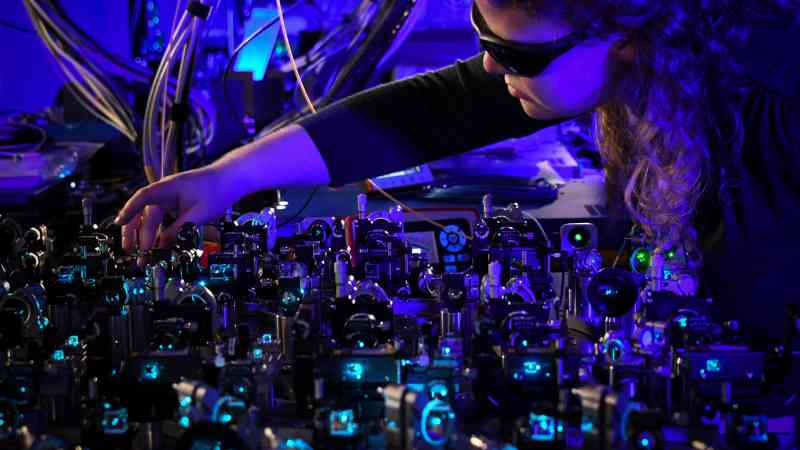

Wood’s headquarters are in Aberdeen and it is listed in London. It employs more than 36,000 people around the world working on engineering and operations across sectors such as energy, minerals, net zero and chemicals.

Ashley Kelty, an analyst at Panmure Liberum, the broker, said that the rise in margins was an encouraging step forward, but rising net debt was a concern. “The overall recovery is taking longer than management expected, having to deal with multiple takeover approaches has obviously knocked the business off track, but investors will hope that the company can now focus on delivery and generating free cashflow from 2025.”

John Wood Group’s shares closed up 2p, or 1.4 per cent, at 134½p.

Post Comment